South Africa's luxury goods market is projected to grow by 15% this year, according to Euromonitor International’s World Market for Luxury Goods 2025 report released on Friday.

Global physical luxury stores have accounted for 81% of personal luxury goods sales so far in 2025, reflecting the sector’s resilience and the continued importance of in-person engagement, the report found.

It highlights that the luxury goods market – valued at $1.5 trillion – remains resilient, despite continued macroeconomic and geopolitical disruptions.

According to the report, South Africa is seeing notable growth in luxury goods, positioning sub-Saharan Africa as a key player in the global luxury market, as affluence rises and consumer tastes shift.

South Africa (15%) stands out in the leading markets for growth alongside Sweden (12%), India (10%), and the United Arab Emirates (9%).

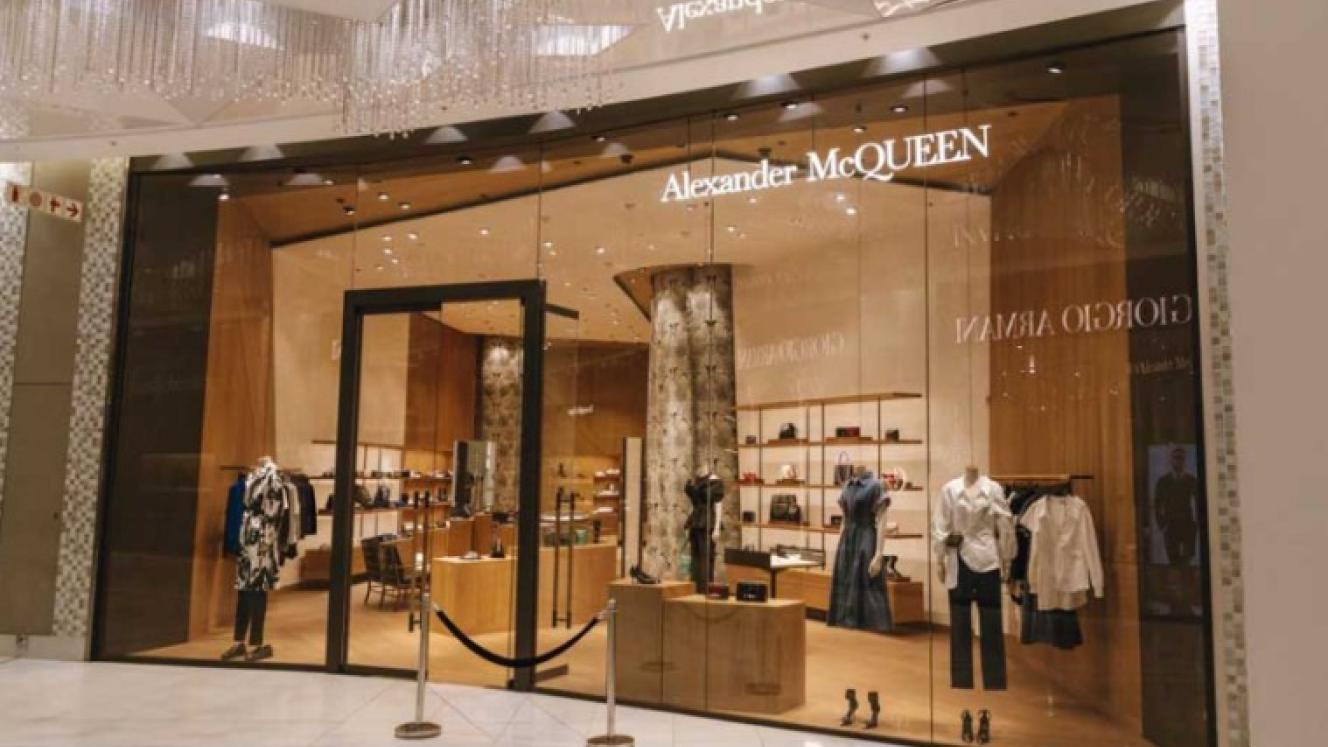

This year, physical stores have remained the dominant channel for luxury goods in South Africa, driven by affluent consumers’ preference for immersive, high-touch shopping experiences.

The expansion of luxury retail spaces, including curated concept stores featuring brands like Dolce & Gabbana, Louis Vuitton and Gucci, elevated the in-store experience. Multi-brand stores and premium venues enhanced accessibility and service, while retailers focused on personalised consultations and exclusive previews to deepen engagement.

The report noted that physical luxury stores were becoming expressions of identity through exclusivity and hospitality. These environments mirror high-end hospitality, with concierge-level service.

Euromonitor International global insight manager for luxury goods, Fflur Roberts, said amidst market uncertainty, the industry was undergoing transformation, shifting from product-centric models to experience-driven engagement.

“Wellness, lifestyle and emotional resonance are emerging as new markers of status, reshaping how brands connect with consumers,” Roberts said.

Research has also shown many affluent consumers value human touch.

According to Euromonitor’s Voice of the Consumer: Retail Survey 2025, 52% of high-income shoppers prefer shopping in-store for fashion – up from 36% in 2023. This highlights renewed appreciation for tactile experiences that digital platforms cannot fully replicate.

Luxury spending has shifted from personal goods towards experience-led categories, reflecting deeper changes in consumer values. Experimental luxury showed resilience, with luxury travel and hospitality markets growing 8% in 2025 to reach $103 billion.

The 60+ age group is rapidly growing in affluence and influence, driven by increased life expectancy, improved healthcare and a generational shift in lifestyle priorities. This cohort is redefining luxury, seeking indulgence and sophistication but also empowerment and simplicity.

Their spending favours luxury offerings that enhance quality of life – from wellness travel, spa-led hospitality and age-inclusive luxury skin care, to home innovations, real estate and luxury retirement villages supporting “ageing in place”.