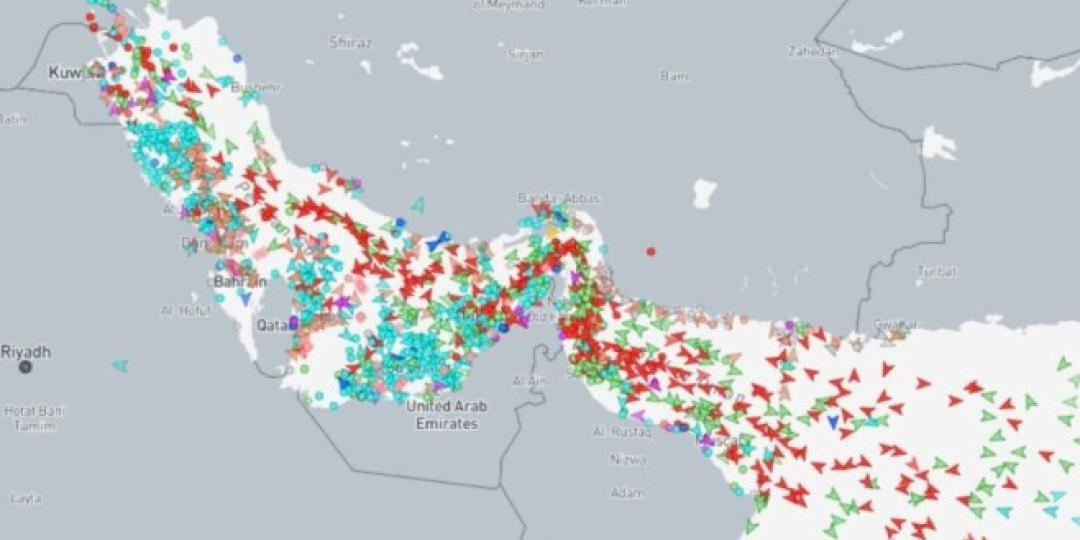

Tanker trade in the Strait of Hormuz, responsible for at least 20% of global oil shipments, has surged amid growing concerns that Iran may close the vital shipping route.

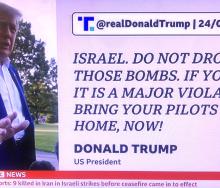

This emerged as Iran and Israel agreed to a ceasefire following 12 days of missile warfare and a highly covert attack by the US on nuclear installations south of Tehran.

At 12 noon on June 24 it was also reported by various sources that Iran had violated the ceasefire, striking devastating blows deep inside Israel.

The Strait of Hormuz, a crucial chokepoint through which about 20 million barrels of oil flow daily, has seen heightened activity as tensions escalate in the region.

Shipping operators are exercising increased caution, with some supertankers reportedly making U-turns or altering their courses to avoid potential threats.

This surge in tanker movements has contributed to a sharp rise in freight rates and insurance premiums for vessels transiting the area.

Maritime experts note that while the overall volume of oil passing through the strait remains steady, the volatility in traffic patterns reflects the uncertainty surrounding the security situation.

Many shippers are frontloading cargo and reinforcing supply chains in response to fears of a possible closure.

Additionally, vessels are travelling at increased speeds to minimise time spent in the high-risk zone, further driving up operational costs.

The prospect of Iran closing the Strait of Hormuz has prompted significant adjustments in tanker operations, underscoring the strategic importance of the waterway to global energy supplies and the fragility of maritime trade in the current geopolitical climate.