Global oil markets are holding steady near $70 per barrel as traders cautiously await clarity on a potential US-Iran deal and monitor the fragility of the ceasefire between Israel and Iran.

The ceasefire has offered some short-term relief but experts have warned that geopolitical risks continue to cloud the outlook for crude flows and shipping.

“The overnight ceasefire between Israel and Iran came earlier than many expected, pushing Brent crude prices back below $70 per barrel,” said Mukesh Sahdev, Rystad Energy’s Global Head of Commodity Markets - Oil.

“Assuming the ceasefire holds, it reinforces our view that de-escalation was more likely than a full blockade of the Strait of Hormuz – a move that would have triggered a sharp spike in oil prices.

“With this in mind, we expect oil prices to hold near the $70 per barrel level while clarity on a US-Iran deal emerges, assuming the ceasefire holds. The prospect of severe economic fall-out from a potential blockade likely motivated both sides to agree to the ceasefire if it is indeed genuine.”

Maritime security specialists Vanguard echoed this cautiously positive tone, while highlighting the ongoing risks.

“While talk of a ceasefire is cautiously optimistic, the situation in the region remains highly fragile with the next 24 hours critical to whether both sides enact and uphold de-escalation,” Vanguard stated in an update.

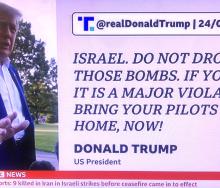

The ceasefire, announced by US President Donald Trump and reportedly accepted by both Israel and Iran, has yet to be fully upheld. Reports of missile interceptions and accusations of violations emerged shortly after the truce was declared.

Vanguard noted that the instability continued to affect Gulf shipping routes, contributing to elevated tanker rates and greater caution among maritime operators. Their assessment underscores the crucial period ahead for determining whether hostilities will truly subside.

Against this backdrop, Rystad Energy outlined how oil market fundamentals remained tight as summer demand builds, encouraging OPEC+ to “remain opportunistic in gradually unwinding cuts, while closely monitoring the product market to maintain backwardation in crude futures and stability in price movements”.

The group is expected to focus on preventing the market from slipping into contango (the situation in which the spot or cash price of a commodity is lower than the forward price), even if that means accepting softer prices temporarily.

For China, a key player in absorbing Iranian oil, flows have already shifted.

“China imported close to 11 million barrels per day (bpd) of crude, with about 10%, or 1.5 million to 2 million bpd, coming from Iran,” said Sahdev.

He noted that US sanctions on Chinese teapot refineries (small independently owned operations) and Singapore traders had halved these flows, leaving tankers waiting off Shandong. Despite this, “the current crude in storage could cover about 90 to 100 days of the country’s crude demand”.

Sahdev said China was unlikely to engage in panic buying, as it had built good buffers in recent months.

Refinery runs are expected to recover, climbing from 14.5 million bpd in June to 15.1 million bpd by September. Meanwhile, Iranian barrels could seek new buyers if peace talks fail or Chinese demand wanes.

“With production remaining near 4.2 million bpd and some increase in Iranian oil refining, there is a two million-bpd exportable surplus,” Sahdev said.

The outcome of peace talks and US negotiations will determine if Iran can bring its barrels to mainstream markets or if it must find alternative destinations.

While US shale production is set to rise modestly, Sahdev cautioned that “US shale needs contango more than a higher oil price,” given recent widening backwardation that complicates hedging strategies.

Overall, the markets are bracing for continued volatility.

“The key takeaway for the oil markets is to observe how the ceasefire and the subsequent US-Iran deal develop,” Sahdev said.