Hydrocarbon output in Mozambique is projected to fall by about 9% in 2026, owing to planned shutdowns and declining natural gas levels at two key fields, according to figures contained in the draft state budget.

Supporting documents for the 2026 Economic and Social Plan and State Budget (PESOE) now before parliament, attribute the expected drop to scheduled maintenance on the Coral South floating platform and lower production at the Pande and Temane fields, Lusophone news agency Lusa reports.

The PESOE proposal anticipates a downturn across virtually all hydrocarbon categories next year, with gas production forecast to contract by roughly 3% and light oil – a by-product – set to decrease by as much as 32%.

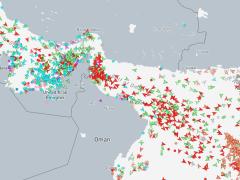

Mozambique currently has three sanctioned development schemes for the vast natural gas reserves of the Rovuma Basin off Cabo Delgado, one of the world’s most significant offshore gas provinces.

Coral South, operated by Eni, is the only project in operation, having come on stream in 2022.

In October, the company approved investment in a second floating liquid natural gas (LNG) unit, Coral North, valued at US$7.2 billion (€6.2 billion). The new platform is expected to double output from 2028 to about seven million tonnes per year of liquefied natural gas.

The Mozambique LNG development (Area 1), led by TotalEnergies and valued at US$20 billion (€17.4 billion), is resuming after being halted for four years due to militant attacks in Cabo Delgado. It aims to produce up to 13 mtpa from 2029. It is expected to be followed by ExxonMobil’s Rovuma LNG project (Area 4), a US$30 billion (€26.1 billion) venture targeting 18 mtpa after 2030.

Gas reserves in Inhambane province in the south are steadily depleting after two decades of extraction, a trend that will weigh on production in the years ahead, the Minister of Mineral Resources, Cristóvão Pale, has said.

The government was seeking additional exploration partners to conduct further surveys around Pande and Temane, stressing the need to identify new gas sources to secure future supplies.

He said authorities remained confident that significant untapped deposits might still exist, noting that exploration “is essentially a venture capital exercise”.

The state-owned Mozambican Hydrocarbons Company (CMH) has also highlighted what it described as a “marked decline” in gas reserves, in its annual report for the last financial year.

A statement from the board, chaired by Arsénio Mabote, warned that one of the company’s major challenges would be mitigating the sharp reduction in output from Pande and Temane in order to sustain current operational performance.

Club of Mozambique reports that the comments appear in the 2024/2025 annual report, finalised in June.

CMH, which is majority-owned by the National Hydrocarbons Company with a 70% stake, is responsible for operational oil and gas production. It was appointed, alongside Sasol Petroleum Temane (SPT) of South Africa, to operate the Pande and Temane fields for a 30-year period under a Petroleum Production Agreement signed in 2000.

The company also participates in Joint Operations Agreements with SPT, signed in 2002, covering the Pande and Temane reservoirs. CMH’s activities are fully integrated with SPT, and the company both produces and markets natural gas.