The Gemini Cooperation has made headlines with its plan to raise schedule reliability above 80%. But can the carriers really get rid of shipping delays?

Shippers, forwarders and ports should remain prudent, Drewry suggests.

In a recent investor presentation, Maersk CEO Vincent Clerc said that charging customers a premium for on-time ship arrivals “is a conversation we’ve started” and added that Gemini needed to show that it had a consistent track record of improved reliability.

But as average waiting times of arriving containerships in Europe lengthened, to an average of 1.9 days in October, ocean carriers found it difficult to keep to their schedules overall.

The maritime intelligence consultants say ship waiting times at several major European ports were longer than the equivalent times at ports in China, based on Drewry Container Capacity Insight data (see graphs down below).

There are several potential causes of shipping delays, including port strikes, port congestion, bad weather, issues with infrastructure and accidents (eg the Ever Given Suez Canal incident), roll-overs and schedule changes. Some of these are clearly outside the control of carriers and/or of ports.

The chart below marries unique Drewry data on port congestion (measured as average pre-berth ship waiting times) and schedule reliability (measured as the percentage of ships arriving within 24 hours of the scheduled arrival promised two to six weeks before).

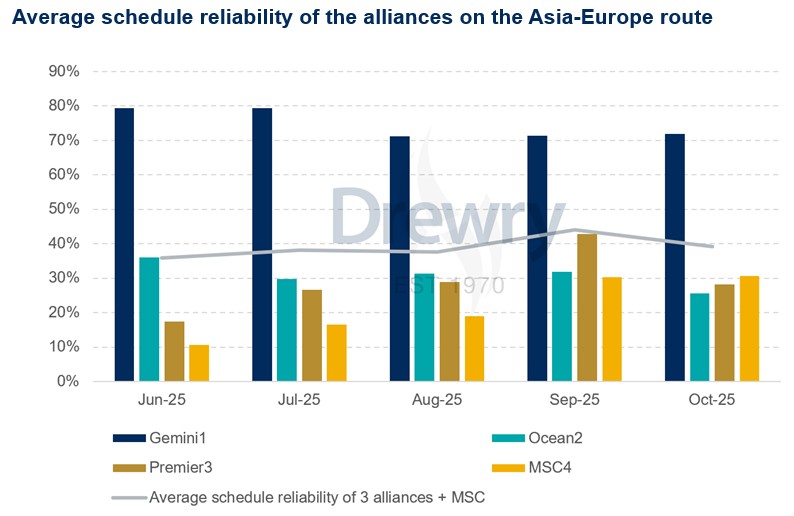

The recent history of schedule reliability on the Asia-Europe route was five months of improvement, to 44% of ships arriving on time, before a decline in on-time performance in October to 39% – see chart. Feeder ships are currently the most exposed to port delays in Europe, according to the consultancy’s market contacts.

In Drewry’s opinion, there is no doubt that higher schedule reliability provides significant benefits to several stakeholders (ports, shippers, forwarders) and avoids sizeable costs and inefficiencies (demurrage costs, inefficient terminal operations, more expensive on-carriage required, etc).

On the Asia-Europe trade, Drewry’s comparison of schedule reliability shows that the Gemini alliance’s ships continue to arrive on time more frequently than those of competing alliances. Kudos to Maersk and Hapag-Lloyd – see chart below. The Gemini alliance also tends to cancel fewer sailings than the other alliances.

Notes: 1 Average of Maersk and Hapag-Lloyd; 2 average of CMA CGM and Evergreen; 3 Average of ONE and YangMing; 4 MSC is considered here a "one-carrier alliance"

Coming back to the idea of carriers charging a premium for on-time services, shouldn't shippers already expect the services to be reasonably on time, instead of being asked to pay more for this?

Drewry consultants are having discussions with shippers on tactics to deal with recurring shipping delays, ranging from short- to long-term measures. They believe that the problem of shipping delays, even if contained, will not disappear completely.

Source: Drewry