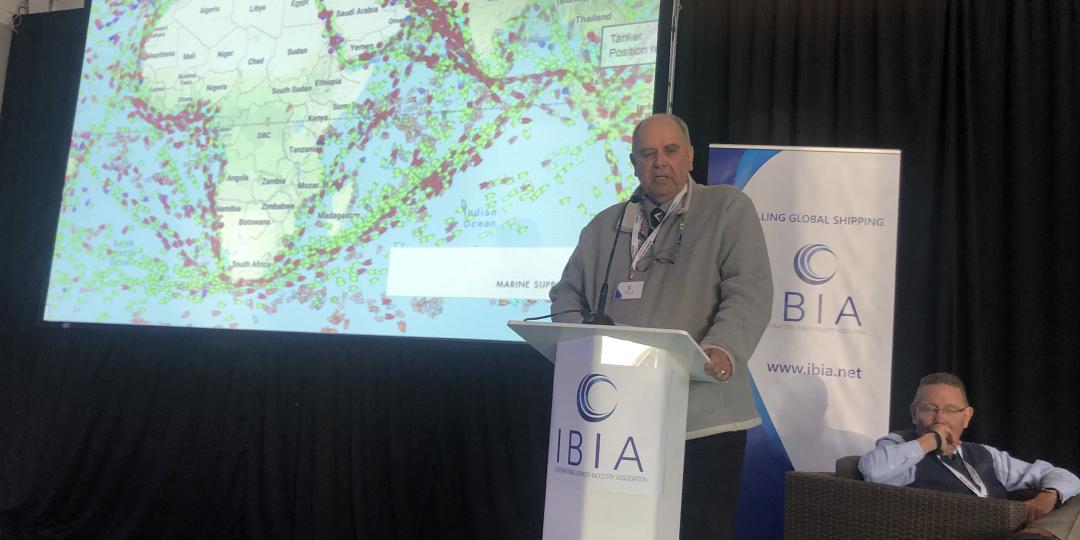

South Africa has what it takes to reclaim its position as a bunker supply point – but it requires a change of mindset.

That’s the view of David Sineke, an enterprise risk manager with a large fuel company, and maritime expert Brian Ingpen.

Since 1996 the number of bunker only calls has dropped from 991 per year to about 600 – a 40% decrease. This despite the fact that SA has very little competition on the continent.

“The economic impact of the loss of 382 ships calling purely for bunkers, if we assumed that we should have at least kept the number of ships calling at a stable rate, is high,” said Sineke. “Estimates put the loss at about R88.7 million - and with the multiplier effect it goes up to R838 million.”

“It’s really not rocket science,” said Sineke. “The country has to encourage and incentivise economic participation.”

This, however, may be more difficult to do in light of growing competition.

In Mauritius authorities have made serious moves to boost the sector – among them exempting bunker fuels from excise duty and value added tax, rebates on port dues, anchorage dues and pilotage and tug services.

Vessels calling for bunkering are also allowed to carry out additional activities such as crew changing and ship handling.

“On the West the developments at the Port of Walvis Bay have to be taken note of,” said Sineke. “This port has already developed an excellent reputation for ship repairs and for repairing oil rigs. A modern syncrolift can lift vessels of up to 2000 tonnes.

“Bunker sales volumes for the entire Africa stand at around 10 million MT per annum. This is not so significant compared to Singapore which sells over 40 million MT yearly, Fujairah in the UAD does 24 million MT and Rotterdam 10.5 million MT.”

But, said Sineke, considering that the total worldwide bunker fuel market was estimated to reach a total volume of 460 million MT by the end of 2020, there was a lot to gain for a country to improve its bunkering situation.

-Liesl Venter