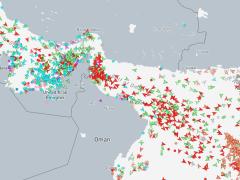

Agreement between Israel and Hamas to pause the conflict may have raised hopes over the prospect of ocean container ships returning to the Red Sea – but it also raises a multitude of issues.

Issues that will clearly lead to another period of uncertainty and volatility in ocean supply chains.

The ceasefire does not necessarily mean a large-scale return of container ships to the Red Sea, says Xeneta’s chief analyst Peter Sand.

It may be a significant development, but carriers will want assurance they have safe passage for crews and ships in the long term and that the situation will not suddenly deteriorate.

“Diversions around the Cape of Good Hope are not what the industry wants, but the situation is stable and being managed. It took many months and extreme disruption to achieve this stability, so carriers will be wary of heading back to the Red Sea too soon. If it goes wrong, they’re back to square one.”

Therefore, Sand does not foresee an immediate large-scale return.

Several carriers have published two versions of 2025 services – one where ships continue to sail around the Cape of Good Hope and the other going through the Red Sea.

“They are ready to make the change when the time is right, but it will be done in a phased way,” says Sand.

“Carriers will start by sending ships with a capacity below 10 000 TEUs through the Red Sea. They will then gradually increase the size of vessels transiting the region before finally introducing the very large 18 000-24 000 TEU containerships.

“The complexity of ocean container shipping networks means it could take one to two months for schedules to transition to ‘normal’ operating conditions through the Red Sea.”

And once ships begin sailing through the Red Sea, shippers can expect “severe disruption”.

“Ships will not be where they are supposed to be and will arrive at ports much earlier (or later) than scheduled. If large numbers of ships arrive at ports at the same time, it will cause massive delays and congestion that will ripple across ocean supply chains.”

And as the situation begins to normalise, the impact on freight rates will be significant.

Sand predicts that spot rates will be extremely volatile but trending strongly downward.

“Even with a forecast 3% growth in global volumes in 2025, TEU-mile demand could be down 11% from 2024 if there is a large-scale return to the Red Sea.”

Combined with record deliveries of new ships, the market will be flooded with capacity, with carriers needing to remove around 1.8m TEUs to retain the status quo.

The potential for freight rates to collapse is good news for shippers on the face of it, says Sand. However, it also presents a problem if they’re looking to lock into new long-term contracts because it is extremely difficult to know when to go to tender and what rates to target.

If a shipper locks into rates for the next 12 months and the market collapses due to a return to the Red Sea, they are paying way over the odds for their freight and putting themselves at a competitive disadvantage.

On the other hand, a return to the Red Sea is far from certain, meaning carriers will have a strong argument for keeping rates elevated.

Clearly, the only certainty is uncertainty.