South Africa’s poorest would benefit considerably if efforts to formalise informal lending and penalise illegal practices were intensified.

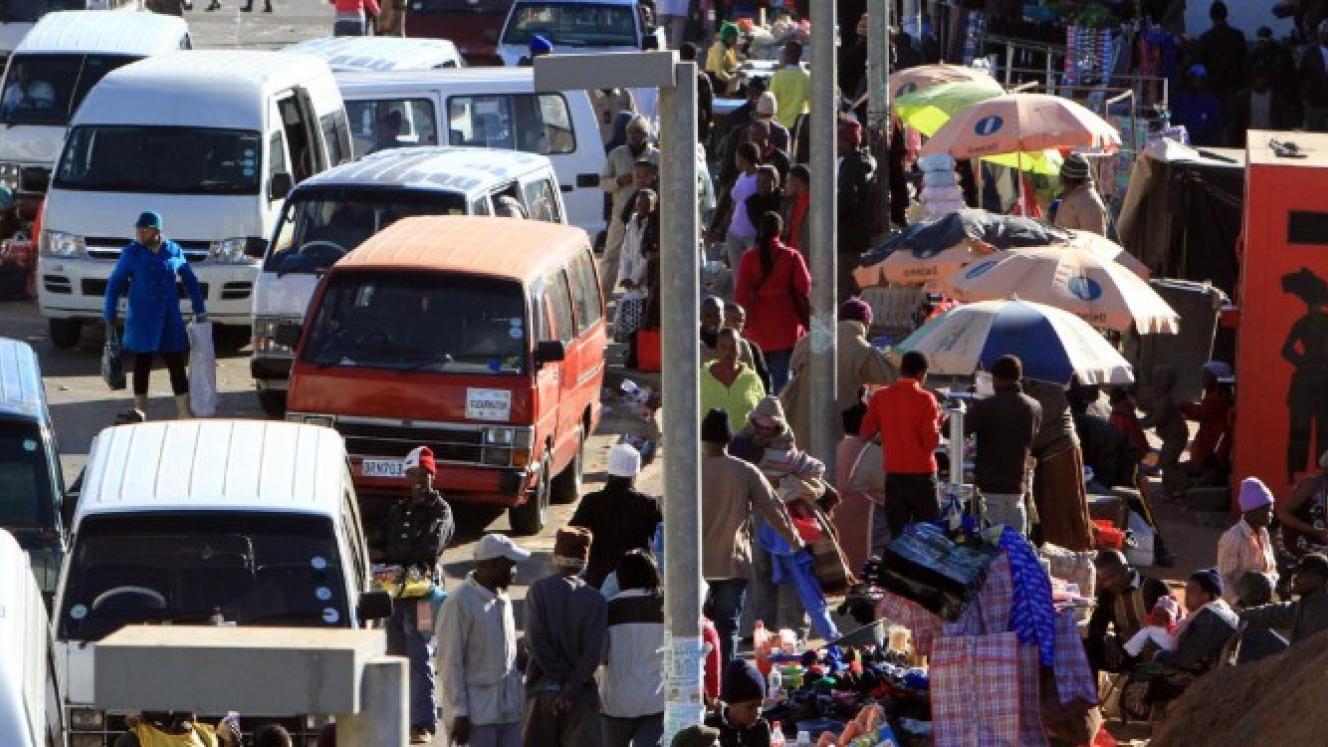

It’s common knowledge that too many South Africans cannot make ends meet and rely on credit for basics like transport, groceries and other essentials.

Finmark Trust data indicates that in 2024, 43% of adults used credit to buy food. The same report found 12 million adults, including those who borrow from informal sources, are in financial distress.

FinMark Trust data from 2022 shows that 90% of adults are financially included, which means they have access to financial products and services appropriate to their needs.

Despite this, many lowest common denominator (LCD) consumers rely on informal services due to barriers such as high fees and lack of documentation, according to FinMark.

These informal services include loan sharks (“mashonisas”) who charge much higher interest rates than the formal providers do – 30-50% per month. This means a R500 payday loan could end up incurring up to R250 in interest.

- Read the full article in our “Columns” section.