South African exports have dominated dry bulk volumes, according to year-on-year (y-o-y) data measured by Linernet, but there’s a distinct downward trend over the last seven years.

This has been confirmed by the independent data aggregator’s Lance Pullan.

Looking at annual recorded volumes since 2019, he said: “Bulk volumes are very closely correlated to rail capacity and performance so the recovery does appear to be losing a bit of momentum.”

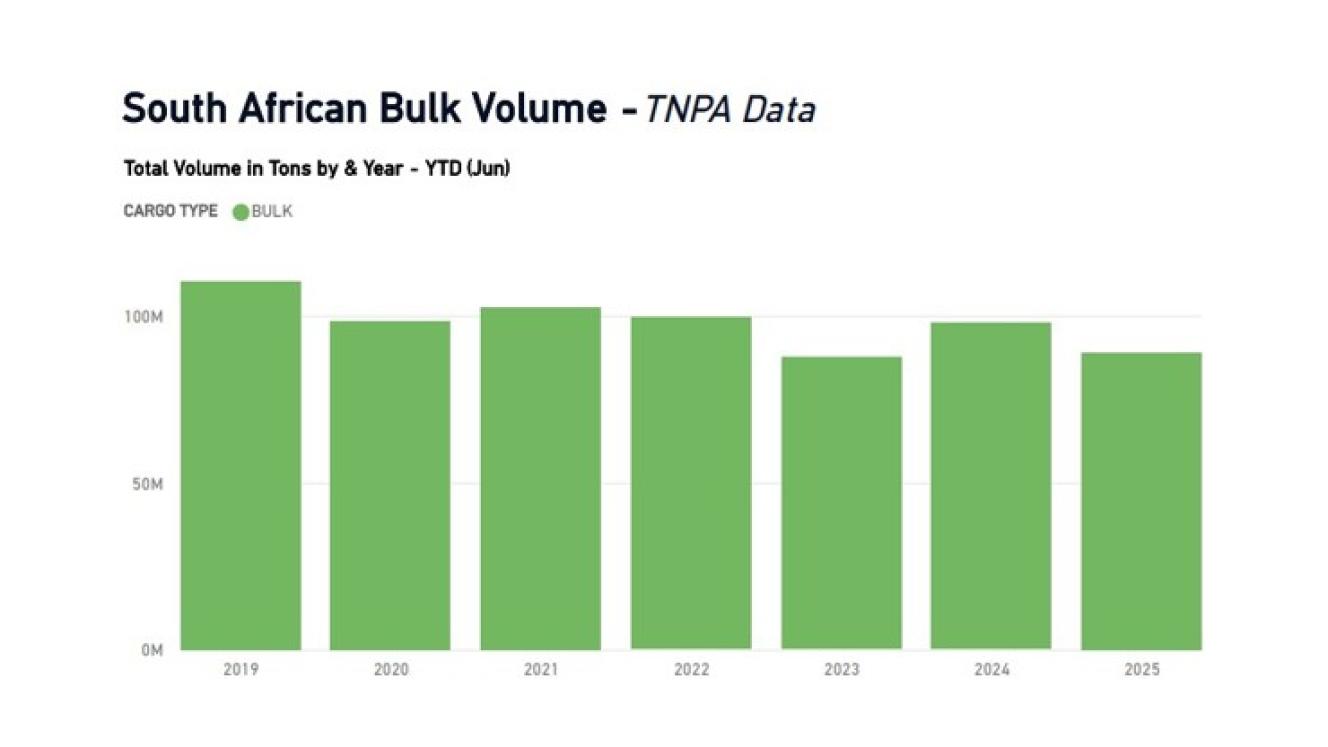

Closer analysis of the data accumulated through Transnet National Ports Authority (TNPA), shows that the last time significantly more than 100 million tonnes were shifted in a year was in 2019, immediately before the supply chain impact of the coronavirus epidemic.

Although 2021 broke through the 100m benchmark barrier once more, showing a slight recovery from 2020, the pandemic’s worst-hit year, volumes since then have been a see-saw affair.

Whereas 2023 volumes decreased markedly compared with previous y-o-y yields, last year just about fell short of the 100m benchmark.

Half-year (H1) in, 2025 is lagging last year’s figures but H2 volumes could surpass 2024 volumes, especially given consistent improvements at TNPA and related parastatal subsidiaries – Transnet Port Terminals and Transnet Freight Rail (TFR).

Most notably, Linernet’s dry bulk data since 2019 confirms very strong exports-vs-imports data.

Ports data in the aggregator’s past seven-year configurations show that Cape Town and East London were mostly flat, while Durban and Port Elizabeth (Gqeberha) had similar volumes.

Ngqura’s dry bulk volumes are on a steady growth trajectory, while Richards Bay and Saldanha performed fairly well, as per the ports’ dry bulk expectations.

Saldanha Bay, specifically, showed a marked volume decrease in 2023.

Coming in a year when TFR’s third-party access developments have been much in vogue as Transnet pushed for much-expanded rail freight, dry-bulk specific ports like Richards Bay and Saldanha could exceed last year’s figures.

But it’s going to take some doing before volumes last seen in 2019 are again realised.