Same tune – different player as Orient Overseas (International) Limited (OOIL) released its first-half result this morning.

With stronger-than-expected demand combined with numerous operational challenges pushing freight rates to unprecedented levels, the carrier this year produced its best H1 result in the Group's history.

“Compared to the same period in 2020, OOCL's total liner liftings for the first half increased by 19%, total revenue by 108%, and revenue per TEU by 74%,” according to a statement.

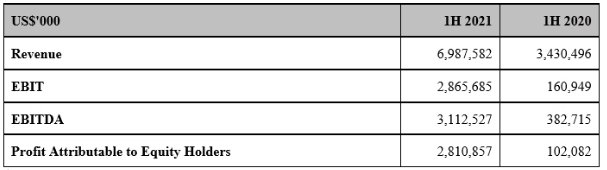

The table below tells the story.

The average price of bunkers recorded by carrier in the first half was US$449 per ton compared to US$424 per ton for the corresponding period in 2020. The price increase, in combination with increased consumption in fuel oil and diesel oil, led to an increase in total bunker costs of 26%.

While no newbuild container vessels were delivered or ordered this year, twelve 23 000-TEU container vessels ordered by the Group in 2020 are expected to be delivered starting 2023.

The line has not made any firm predictions, but is expecting more of the same in the months ahead.