The latest World Trade Organization Goods Trade Barometer points to slowing trade growth due to disruptions in critical sectors.

Following its sharp rebound from the initial shock of the Covid-19 pandemic, global merchandise trade is slowing, with production and supply disruptions in critical sectors dampening growth alongside cooling import demand.

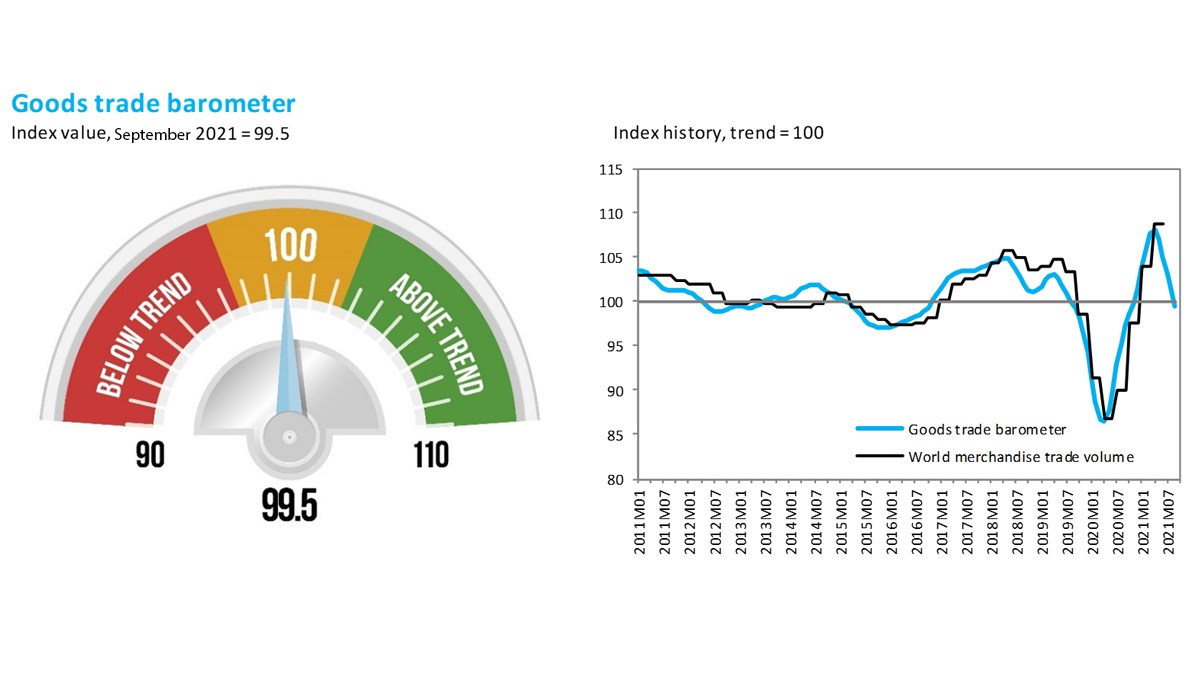

The barometer is a composite leading indicator providing real-time information on the trajectory of merchandise trade relative to recent trends ahead of conventional trade volume statistics. The latest barometer reading of 99.5 is close to the baseline value of 100 for the index, indicating growth in line with recent trends.

The return to trend follows the record reading of 110.4 in the previous barometer issued in August, which reflected both the strength of the trade recovery and the depth of the pandemic-induced shock last year. Recent supply shocks, including port gridlock arising from surging import demand in the first half of the year and disrupted production of widely traded goods such as automobiles and semiconductors, have contributed to the barometer's decline.

It now appears that demand for traded goods is also easing, as illustrated by falling export orders, which further weighed down the barometer. Cooling import demand could help ease port congestion, but backlogs and delays are unlikely to be eliminated as long as container throughput remains at or near record levels.

All the barometer's component indices declined in the latest period, reflecting a broad loss of momentum in global goods trade. The steepest decline was seen in the automotive products index (85.9), which dropped below trend as a shortage of semiconductors hampered vehicle production worldwide. This shortage was also reflected in the electronic components index (99.6), which fell from above trend to on trend. Indices for container shipping (100.3) and raw materials (100.0) also returned to near their recent trends. Only the airfreight index (106.1) remained firmly above trend as shippers sought substitutes for ocean transport.

The outlook for world trade continues to be overshadowed by considerable downside risks, including regional disparities, continued weakness in services trade, and lagging vaccination rates, particularly in poor countries. Covid-19 continues to pose the greatest threat to the outlook for trade, as new waves of infection could easily undermine the recovery.