The East African Community (EAC) is generally regarded by the sub-Saharan logistics industry as a regional leader of sorts, a vanguard trading bloc with its own constitution, which was a template for the African Continental Free Trade Area (AfCFTA).

However, all things being relative, the EAC has the same problems holding back overborder hauliers in the SADC region – rotten roads, bad borders and a plethora of cargo complexities hobbling supply chain efficiencies, such as they are.

According to Gibran Mwakuja, business development specialist and heavy transport specialist at Raphael Logistics in Tanzania, the movement of goods in East Africa is “slow, costly and inefficient” for several reasons.

“Many roads are in bad condition, especially outside major cities. Rail networks are old and limited, reducing the use of cheaper transport modes.”

Then there are the ports.

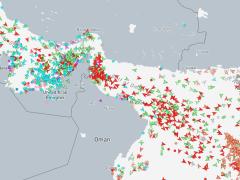

“Mombasa and Dar es Salaam often face congestion, leading to long delays for ships and trucks.”

Inland container depots and dry ports are also not well connected to main corridors, he adds.

As for complex customs and border procedures, Mwakuja is not the first to highlight that regional transits, for the most part, are far from AfCFTA’s ideal of border harmonisation – a crucial necessity for growing intra-regional trade.

“Crossing borders in East Africa can take hours or even days due to slow customs clearance,” Mwakuja says.

Mull that around a little and then consider, for context, that cross-border transporters in southern Africa often “envy” the EAC’s “efficient” borders.

Putting a finer point on it, “different documentation requirements in each country cause confusion”, Mwakuja says.

These include each country having its own rules for permits, axle loads and road usage.

Delving deeper into the cause of bottlenecks, he mentions the following:

- High operating costs – fuel prices are high and unstable.

- Limited skilled workforce – there is a shortage of well-trained drivers, logistics managers and equipment operators.

- Low levels of technology adoption – many logistics companies still rely on manual paperwork instead of digital tracking or route planning systems.

- Security and political challenges – some routes, especially through the Democratic Republic of the Congo and South Sudan, face banditry, theft or political instability.

- Limited investment and financing – many local logistics companies lack access to finance to expand or modernise their fleets.

And although governments generally talk about infrastructure development providing the necessary means for regional logistics to flourish, budgetary constraints throw a proverbial spanner in the works, Mwakuja says.