Global shipping earnings have surged to their highest levels since 2022 following the introduction of tit-for-tat port fees between the United States and China.

Following last week’s volatility in already unsettled trade flows and tightened vessel availability across several market segments, the ClarkSea Index – which tracks average earnings across tankers, bulk carriers, containerships and gas carriers – climbed above $30 000 per day on Friday.

It was the first time that the maritime industry’s cross-section index reached that level in nearly three years, sea intelligence consultancy Clarksons Research reports.

The benchmark rose by around 5% week-on-week to $30 461 a day, standing more than 50% above its ten-year average.

The latest rise follows the start of reciprocal port charges last Tuesday, when both Beijing and Washington imposed special levies on each other’s shipping interests. China began collecting a $56 per net ton fee on vessels that are US-owned, operated, built or flagged, while exempting Chinese-built ships and empty vessels entering shipyards for repair.

The levies came as a direct response to the US implementing similar port fees on Chinese-linked tonnage on the same day.

Industry data shows that tanker markets have been among the main beneficiaries of the disruption. Average very large crude carrier (VLCC) earnings rose by about 10% to $90 000 a day, while medium-range (MR) tanker returns jumped 44% to $25 000 a day, as owners capitalised on shifting trade patterns and tightening tonnage supply.

The container sector also saw significant gains, driven by higher spot freight rates and capacity management measures such as blank sailings. The Shanghai Containerized Freight Index advanced by 13% over the past week to reach around 1 310 points, supported by general rate increases on the transpacific route.

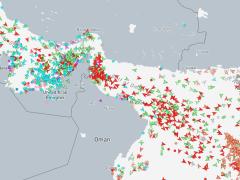

Clarksons estimates that between 2% and 7% of global cargo tonnage – or roughly 1% to 3% of the world fleet by number – could now be directly affected by the new levies when calling at Chinese ports.

While many shipowners are expected to mitigate exposure through redeployment, analysts warned that the measures were likely to create short-term inefficiencies, chartering preferences and logistical delays, all of which tend to be “overall supportive” of freight markets in a tight environment.

Over the weekend, China’s Transport Minister, Liu Wei, called on global shipping and port operators to reject protectionism and work together to preserve open trade.

“All companies engaged in shipping should work together to promote a fair, just and open environment and safeguard the common interests of global trade and economic development,” Liu said at the North Bund Summit in Shanghai.

“We will continue to uphold the principles of mutual understanding and shared benefits to overcome challenges together and create a new ecosystem for sustainable development in global shipping.”

The tit-for-tat measures have been described by analysts as the latest escalation in the maritime dimension of the US–China trade tensions, with shipowners, charterers and logistics providers now assessing potential impacts on supply chains and port operations worldwide.