As shipping capacity continues to outpace supply, carriers are continuing to rake in record profits.

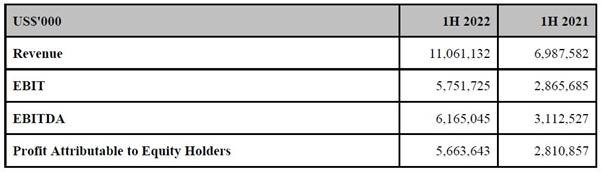

Orient Overseas (International) Limited (OOIL) today announced a profit attributable to equity holders of $5 663.6 million for the six-month period ended June 30, compared to $2 810.9m for the same period in 2021.

Earnings per ordinary share for the first half of 2022 were $8.58, compared to $4.42 for the same period last year.

The Group attributes its spectacular earnings to the continuing “extraordinary” conditions prevailing in the container shipping market. “As has been the case for over two years, our market is neither enjoying an extraordinary demand boom, nor suffering from any lack of vessels in deployment. Rather, levels of demand, which are better than expected but not phenomenally strong, continue to outpace the effective level of supply, which is under significant downward pressure from a combination of congestion, delays and disruptions.

“These market forces pushed freight rates upwards on most trade lanes, and it is these market forces, in addition to our attention to cost control, that have driven the strong profitability that has been achieved during the period.”

The first six months of 2022 produced the highest half-year revenue in the Group’s history. Compared to the same period in 2021, OOCL’s total liner liftings for the first half of 2022 reduced by 7%, total revenue increased by 61%, and revenue per TEU increased by 74%.

The average price of bunkers recorded by OOCL during the period under review was $729 per ton compared to $449 for the corresponding period last year. The price increase of 62% has led to a 46% increase in total bunker costs, even though consumption of both fuel oil and diesel oil was lower in the first half of this year than the first six months of 2021.

No newbuild container vessels were delivered, and no new order was placed by the Group. The twelve 23 000-TEU container vessels ordered in 2020 are expected to be delivered starting from 2023, and the ten 16 000-TEU container ships ordered last year will be delivered from 2024 fourth quarter to 2025 fourth quarter.

Looking forward, the Group says an array of conflicting signals provides little clarity in terms of outlook.

“At the time of writing, our ships are sailing full on our main long-haul trade lanes, and are forecast to continue to be fully loaded in the coming weeks. There has not been much evidence so far of the kind of significant seasonal uptick that is often a feature of the traditional Transpacific peak season. We continue to monitor the situation closely.”