China’s exports of rare earth magnets fell in September, fuelling renewed concern that Beijing could once again use its dominance over the supply of these critical materials as a bargaining chip in trade talks with the United States.

According to customs data released on Monday, shipments dropped 6.1% from August to 5 774 tonnes, ending three consecutive months of gains. The decline came even before Beijing announced a sweeping expansion of its export licensing regime earlier this month.

The fall in exports has rekindled fears that China – which supplies the majority of the world’s rare earths, essential for products ranging from electric vehicles and smartphones to US defence systems – may tighten controls as tensions with Washington resurface.

By the second quarter (Q2) of this year, Beijing had already imposed export curbs on several rare earth materials and related magnets, coinciding with negotiations over triple-digit US tariffs on Chinese goods. Four months later, after both sides revived threats of new tariffs and restrictions, analysts say concern is mounting that China could revert to similar tactics, undermining a June deal aimed at easing the flow of critical minerals.

“The sharp swings in rare earth magnet exports show that China knows it holds a key card in international trade talks,” said Chim Lee, senior analyst at the Economist Intelligence Unit.

While September exports were still 17.5% higher year-on-year, the month-on-month decline suggests that Chinese authorities have intensified scrutiny of export applications, similar to measures seen during the height of the trade war in 2025.

Last week, China’s commerce ministry accused Washington of “deliberately misunderstanding” its rare earth export controls and insisted that licences for civilian uses would continue to be approved. However, industry analysts remain wary that civilian industries could again become collateral damage if Beijing tightens access to materials used by US defence manufacturers.

“China’s ability to throttle rare earth exports is an exceptionally powerful tool,” said Dan Wang, China director at Eurasia Group. “Beyond production disruptions, such measures heighten insecurity over access to industrial inputs and reinforce dependence on China.”

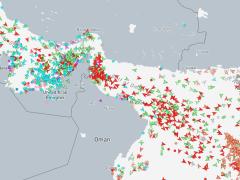

Germany, South Korea, Vietnam, the United States and Mexico were the top five destinations for Chinese rare earth magnet exports in September. Over the first nine months of 2025, total shipments reached 39 817 tonnes, down 7.5% compared with the same period last year. Exports to the United States dropped 28.7% from August, while those to Vietnam surged 57.5%.

The Netherlands recorded a 109% increase, though analysts noted this figure likely reflected activity through Rotterdam, a major transit hub for European trade.

Just before the release of the latest data, US President Donald Trump said aboard Air Force One that he did not want China to “play the rare earth game with us”, suggesting he might delay reimposing tariffs above 100% if Beijing agreed to buy more American soybeans.

Beijing, however, appears unmoved. It maintains that its expanded export controls – set to take effect just days before the November 10 expiry of the current 90-day tariff truce – are in line with measures used by other major economies.

President Xi Jinping is due to meet Trump later this month in South Korea, but economists warn that trade friction between the world’s two largest economies is likely to remain a defining feature of global commerce.

“The surge in exports during the third quarter followed China’s temporary easing of controls earlier this year,” said Lee. “But with the recent tightening, we expect those numbers to fall again.