South Africa must expedite a regionalisation agreement with Brazil to allow for imports from areas not affected by the latest outbreak of Highly Pathogenic Avian Flu in the South American country.

This was the view of the Association of Meat Importers and Exporters (Amie) which has warned that there could be “serious economic and food insecurity consequences” for South Africa as a result the recent outbreak of bird flu in the state of Rio Grande do Sul.

Amie said local poultry producers would not be able to meet the gap in supply of poultry offal (feet, gizzards, and skins) and mechanically deboned meat (MDM), which would drive up prices and threaten the affordability and accessibility of basic protein for millions of people.

This comes after the South African Poultry Association assured the market last week that local producers would be able to meet the shortfall in supply by producing an additional four million birds per month.

Brazil is the world’s largest exporter of poultry products, and accounts for 73% of poultry (excluding MDM) imported by South Africa, including frozen bone-in chicken and offal (feet, livers, necks and carcasses).

It is also the source of 92% of all MDM – a vital ingredient in processed meat products – imported to South Africa. A monthly average of 18 000 metric tonnes was imported from Brazil over the past year.

“Chicken offal and MDM are not luxuries. They are foundational to school feeding programmes, and the production of processed meats, which are the most affordable proteins for low-income households,” said Amie CEO, Imameleng Mothebe.

He said Brazilian MDM was the source of more than 400 million poultry-based meals per month for South Africa.

“Whilst we appreciate the commitment by SA poultry producers to increase their production by four million birds per month during the closure of Brazil poultry exports, the fact is that local producers alone cannot fill the gap in the production of offal, and SA effectively does not produce MDM at commercial scale.

“In addition, alternative international markets also do not have the scale or available supply of the product mix to replace Brazil’s exports to South Africa.”

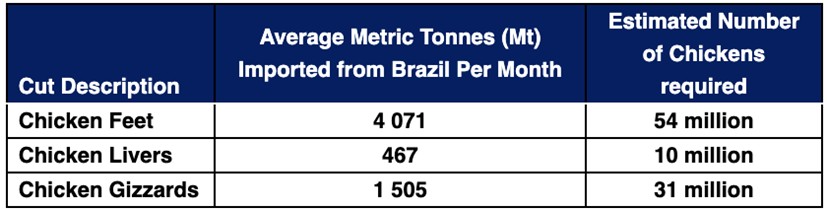

The table below of official South African import statistics per month, indicates the number of chickens required per category to meet local demand for offal.

Using the estimated output of an additional four million birds a month from local producers, Amie noted that the following shortfalls in offal per month would remain:

- Chicken feet – 3 773 MT tonnes per month

- Gizzards – 1 315 MT tonnes per month

- Livers – 287 MT tonnes per month.

“Without urgent action to put in place a regionalisation agreement with Brazil, which would allow for the import of products from areas not affected by the outbreak, price increases and food shortages for consumers and job losses for local manufacturers of processed meats, who employ over 125 000 workers, will follow,” Mothebe said.

He said the economic impact of the shortfalls were already being felt in the market.

MDM prices surged from R13 to R31/kg, while offal like gizzards and skins had seen double-digit increases. These increases would be compounded by rising input costs, especially with the recently announced fuel levy hike in the national budget, which added inflationary pressure across the value chain, said Amie.

“We support government continuing engagements with Brazil towards regionalisation, a concept that demarcates affected areas whilst the rest of the country remains open. Regionalisation is widely accepted and supported by the World Organisation for Animal Health, especially in light of the ongoing global diseases phenomenon,” said Mothebe.

Many countries are currently concluding regionalisation agreements with Brazil and will soon be reopening their markets to Brazilian imports. This week Namibia announced the reopening of poultry imports from Brazil as a result of concluding regionalisation agreement between the two countries.

“We urge that the conclusion of engagements between South Africa and Brazil are expedited, to minimise the impact on the South African economy and consumers alike. The current situation is not just a trade issue; it’s about protecting jobs, businesses, consumer affordability and food security,” said Mothebe.