The latest World Ports Tracker Report, published by the International Association of Ports and Harbors (IAPH), has confirmed industry predictions that the global supply chain crunch has ended, with the last quarter seeing a drop in average call sizes in all port regions compared to the third quarter of 2022.

The most pronounced is in North America with a fall of 15.9%, Latin America (-8.5%) and Northern Europe (-8.3%).

Co-author and IAPH risk and resilience committee member Professor Theo Notteboom commented: “Over half of the responding ports are reporting year-on-year container vessel call growth rates of over 2%. The fall in call sizes was significant in most regions in the final quarter of last year, although they do remain above the pre-pandemic figures of early 2019. Overall, ports are slightly less optimistic than three months ago about container traffic evolution over the next year. 40% of them expect TEU volume stagnation and 11% expect a decline, most notably those responding from North America and Europe.”

The report for the fourth quarter of 2022 also points to an overall reduction in congestion, a general improvement in truck availability, stable port worker availability, and inland storage capacity.

In terms of port investment plans in advancing infrastructure and sustainability in ports, in both cases, 42% and 50% of investments are being executed as planned, respectively with 39% and 37% of remaining investment projects only incurring minor delays in both categories, says Notteboom.

“What is most noticeable is that only 8% and 7% of all ports responding do not have investment plans in infrastructure and sustainability. Ports cited investment activity in automation, digitalised infrastructure, pre-delivery inspection sites for electric vehicles, as well as sustainability-related investments in onshore power and the electrification of port materials handling equipment, including vehicles.

“In addition, one in three of the global container ports who responded confirmed major terminal capacity expansions or upgrades becoming operational in 2023. Similar upgrades will be operational in 23% of the bulk ports who replied. 15% of ports with cruise tourist activities and 8% with passenger activities will get upgrades this year and 11% of liquid bulk terminals will be expanded,” he added.

In an additional question related to land use, 42% of the responding ports stated that they intended to devote more land to logistics and distribution service activities. A quarter will commit to expanding industrial activities. Another interesting outcome of the survey is that 31% of ports plan on using land for non-fossil energy production, with 13% expanding existing energy production facilities.

IAPH managing director Patrick Verhoeven commented: “The noticeable upgrades being delivered to terminals in 2023 is a clear affirmation of the positive investment sentiment ports communicated to us during the Covid-19 pandemic. The intended further investments by ports in improved land use, sustainability-related projects and in the energy transition means that our industry is responding to close the gaps in port infrastructure despite the current challenging investment conditions.”

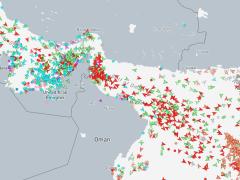

The survey combines confidential survey-based data collection on container, bulk, tanker/gas and general cargo activities from its membership and quarterly comparative port performance data from S&P Global.