Shipping major Hapag-Lloyd has concluded the first nine months of 2021 with significantly higher results than the same period last year, much higher freight rates thanks to persistent excess demand, and higher transport volume despite operational challenges.

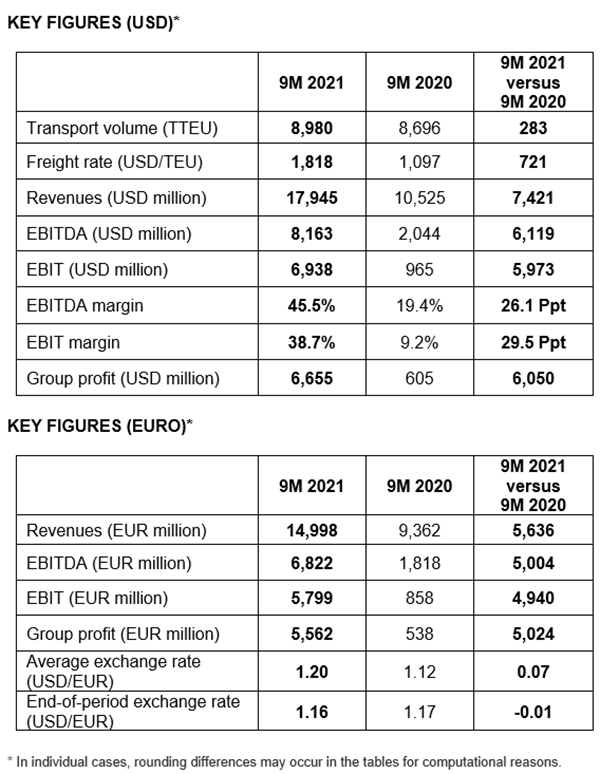

Its Ebitda, at US$ 8.2 billion, and Ebit at US$ 6.9bn, far exceed figures for the same period last year. At the same time, the Group profit has improved to US$ 6.7bn. (See comparative table below).

Revenues rose in the first nine months by approximately 70%, to US$ 17.9bn - primarily the result of a higher average freight rate of 1 818 US$/TEU (9M 2020: 1 097 US$/TEU).

“This significant increase is mainly the result of persistently high demand for container transport, with scarce capacity. In addition, transport volumes were up to 8 980 TTEUs and thereby 3% higher than the comparable figure for the previous year,” said CEO Rolf Habben Jansen.

The line did, however, have to deal with an uptick in transport expenses – up 16% to US$ 8.9bn, due in part to higher costs for container handling and an increased average bunker consumption price, which stood at US$ 452 per tonne in the first nine months (9M 2020: 402 USD per tonne).

Looking ahead, earnings momentum is expected to remain at a high level for the rest of the year.

The earnings forecast for the entire year was adjusted upwards on October 29. For the 2021 financial year, an Ebitda in the range of EUR 10.1 to 10.9 billion (previously: EUR 7.6 to 9.3 billion) and an Ebit in the range of EUR 8.7 to 9.5 billion (previously: EUR 6.2 to 7.9 billion) are now expected.