Predicting growth in demand in the seafreight sector has never been an exact science – and in 2020 the variables have never been greater.

According to information released by consultancy Sea-Intelligence, demand data for September published by Container Trade Statistics (CTS) saw global demand grow by 6.9% Y/Y, with positive growth in all import regions except for South America.

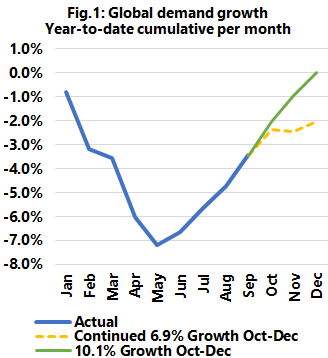

“The demand recovery in 2020 has been very stark,” says the consultancy’s CEO Alan Murphy. “However, the depth of the pandemic impact means that year-to-date, the demand in 2020 is still a negative -3.5% compared to January-September 2019. However, with the growth in recent months, it is relevant to ask whether there is a likelihood that 2020 will actually end with full-year volume growth compared to 2019.”

This of course begs the question: “What will the demand growth rate be for the remaining part of 2020?”

Murphy points out that the traditional links between macroeconomics and container volumes simply do not apply in 2020 - and nor does the usual seasonality. “Instead, we have looked at the question from a slightly different angle. If the current rebound continues – i.e. with a 6.9% growth Y/Y for the three months in 2020-Q4, what would the impact then be on the full-year growth?”

He explains: “Figure 1 shows that with a 6.9% Y/Y growth in Q4, 2020 demand growth will still be a negative -2.0% Y/Y. On the other hand, what would it take to reach 0% i.e. no Y/Y growth decline in 2020? As it turns out, a 10.1% growth across Q4 would mean that the full-year demand volumes in 2020 will be on par with those in 2019 by the end of December.”

In the remainder of the analysis, underlying consumer trends and volume development on a regional level were examined to see whether the ongoing volume boom would indeed continue and spread to other geographies. “The data showed that although a substantial part of the rebound is being driven by North America imports, the recovery is becoming more broad based in September than in August. However, given the potential impact of a second wave in Europe and the temporary nature of this exceptional demand growth in North America imports, it does not seem likely to spread to other geographies.”