Africa’s freight industry is charting a resilient course through turbulent global trade waters, posting growth across maritime, air and road transport, the latest Africa Global Logistics’ (AGL) market report shows.

Titled Africa Market Trends: Navigating Growth Amid Global Trade Tensions, the report by MSC’s hinterland logistics subsidiary reveals that, despite geopolitical challenges, including new US tariffs, the continent’s logistics sector is leveraging regional integration and partnerships to sustain momentum.

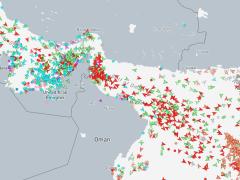

The report highlights 4.2% year-on-year (y-o-y) growth in global container shipping volume in the first quarter of 2025, with sub-Saharan Africa leading as the top import region, recording an 8% increase.

The Asia-Africa trade lane, particularly China, drove this growth, with bilateral trade reaching $134 billion in the first five months of 2025, up 12.4%.

“Shipping companies strategically use capacity management (allocation) – including blank sailings – to control supply-demand balance and maintain pressure on freight rates, thus explaining the general rate increases to West Africa, East Africa and Southern Africa,” AGL noted in the report.

New high-capacity vessel services have been launched to meet this demand, signalling long-term investment in African trade routes.

According to the report, air cargo also showed resilience, with a 4.7% demand y-o-y increase. Capacity expanded by 9.7%, driven by perishables like Kenya’s vegetables and flowers, bolstered by trade agreements with the UAE, UK, and Europe. E-commerce, although only comprising 0.5% of global revenues, is gaining traction, with Astral Aviation handling 500 tonnes weekly from China to South Africa.

Boeing forecasts that African air cargo volumes will double over the next 20 years, with stronger ties to China and India.

According to the report, ground transport is also undergoing a renaissance, fuelled by the African Continental Free Trade Area (AfCFTA). Major corridors like Mombasa-Kampala-Kigali and Dar es Salaam-Kigali-Bujumbura are enhancing regional trade.

Rail investments, dubbed the ‘Great Railway Race’, include China’s Belt and Road Initiative funding Kenya’s Standard Gauge Railway and Zambia’s expansions, while the US backs the Lobito Corridor. These projects highlight transport networks as tools of geopolitical influence.

However, US tariffs pose challenges and its withdrawal from the WHO and suspension of USAID projects further strain healthcare logistics. In response, China’s pledge to eliminate tariffs on imports from 53 African nations with diplomatic ties aims to deepen economic relations.

“It’s important to note that the US tariffs increase has a relatively low impact, considering Africa’s dependence on the US. However, trade agreements with Asian and European partners present viable alternatives to this new American trade strategy,” the AGL report said.

Additionally, it noted that the strengthening intra-Africa trade relationships could expedite the establishment of the AfCFTA, fostering greater economic integration and resilience.

According to the report, Egypt and Kenya are poised to capitalise on Africa’s freight sector growth, leveraging their strategic positions as key logistics hubs. Facing universal 10% US tariffs, both nations can benefit from reduced Asian competition, enhancing their roles in regional trade.

Egypt’s proximity to Suez Canal routes and Kenya’s dominance in perishables like vegetables and flowers, bolstered by its global trade agreements, position these countries to drive intra-Africa trade and e-commerce under the AfCFTA.

“The continent finds itself at a pivotal moment where current geopolitical tensions, while creating immediate challenges, also accelerate necessary diversification and regional integration efforts across all freight sectors,” the report noted.