Soya, one of South African agriculture’s big success stories, is at risk of becoming another victim of the country’s struggling logistics sector as sluggish economic growth reduces local consumption and increases pressure for exports.

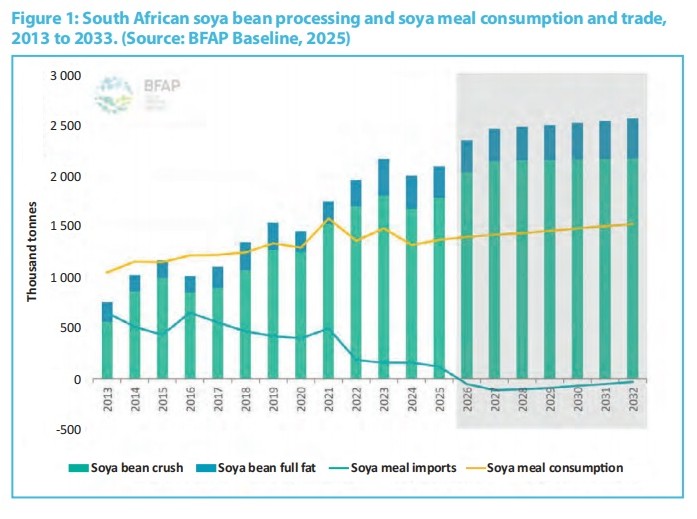

Prof. Ferdi Meyer, director of the Bureau for Food and Agriculture Policy (BFAP), says over the coming decade, “local soya meal consumption is projected to expand at an annual rate of only 1,6% compared to the 2,3% annual growth recorded over the past decade”.

This is because of genetic improvements in particularly the poultry sector, leading to reduced livestock protein requirements. More importantly, poultry sales have taken a beating due to the moribund local economy.

“As a result, unless South Africa experiences a significant improvement in its economic growth trajectory, the soya bean industry will need to focus on expanding its presence in the export

market for both soya beans and soya meal,” says Meyer in a report to the local oilseeds sector.

BFAP anticipates soya bean production to increase by approximately 40% over the next decade to reach 3,2 million tonnes, largely thanks to yield improvements. Assuming that local crushing capacity will remain at around 2,3 million tonnes, surplus volumes of up to 700 000 tonnes will have to be exported annually.

Production increased from 264 000 tonnes cultivated on 165 000 ha in 2008 to more than 2,7 million tonnes across 1,1 million ha in 2023.

“The high cost of road freight in South Africa weighs heavily against exports,” says Kellie Becker, managing director of canola processor, Southern Oil.

“Even with the known restrictions at South African ports, oilseeds and their products are becoming more accessible to international markets. To minimise the effects of oversupply in the local market, we need to be aware of international opportunities as well as product specifications and requirements. By doing so, the market space for oilseed production will continue to grow and the associated benefits will remain.”

The graph shows a steady rise in domestic soya meal consumption until 2021, after which volumes have largely remained stable. SOURCE: BFAP