With every avenue now exhausted by road transport operators in Eswatini, a new road levy tax will continue to hit drivers at the petrol pump.

Road freight companies had joined public transport operators, trade organisations, unions and members of the business community to appeal the road tax, but to no avail. Government is forging ahead with this new form of revenue generation, and will not amend, much less repeal, the tax.

“We saw this coming, but we haven’t been sitting on our hands. We’ve been lobbying for tax relief on this matter since the levy was first made law, although not yet implemented, more than a year ago. This is just an inopportune time for a new tax on road users. This is especially true for commercial road users like cargo haulers,” said the managing director of a road cargo firm located at the Matsapha industrial site halfway between the capital Mbabane and the commercial hub Manzini.

Because his firm is regularly contracted by government for work, and because revenue matters are considered a sensitive issue by government, he asked that Freight News withhold his name.

On 1 April, a R0.40 per litre Roads Authority Levy was put into effect by government, as stipulated by the Roads Authority Act of 2023. However, the price did not actually appear at the pumps until May.

“The levy aims to ensure the sustainable maintenance and improvement of the nation’s road infrastructure, enhancing transportation efficiency and safety for all road users. The funds that will be collected will be dedicated to the upkeep, rehabilitation and development of road networks nationwide,” said Lindiwe Mbingo, the principal secretary in the Ministry of Natural Resources, which has authority over petroleum resources in the country.

The National Roads Transportation Council, representing commercial road users, has led the objections to the road levy, noting that road transportation companies already pay a R3.80 per litre road tax. The council has a good relationship with government and has worked successfully in public-private initiatives before.

The council argued that a road usage tax would be passed on to the public directly at the pump while also resulting in the cost being passed on to road freight customers. At a time when government has permitted a boost in the price of electricity by 8% and water by 12%, the addition of a road tax would unduly stress consumers financially, the council argued.

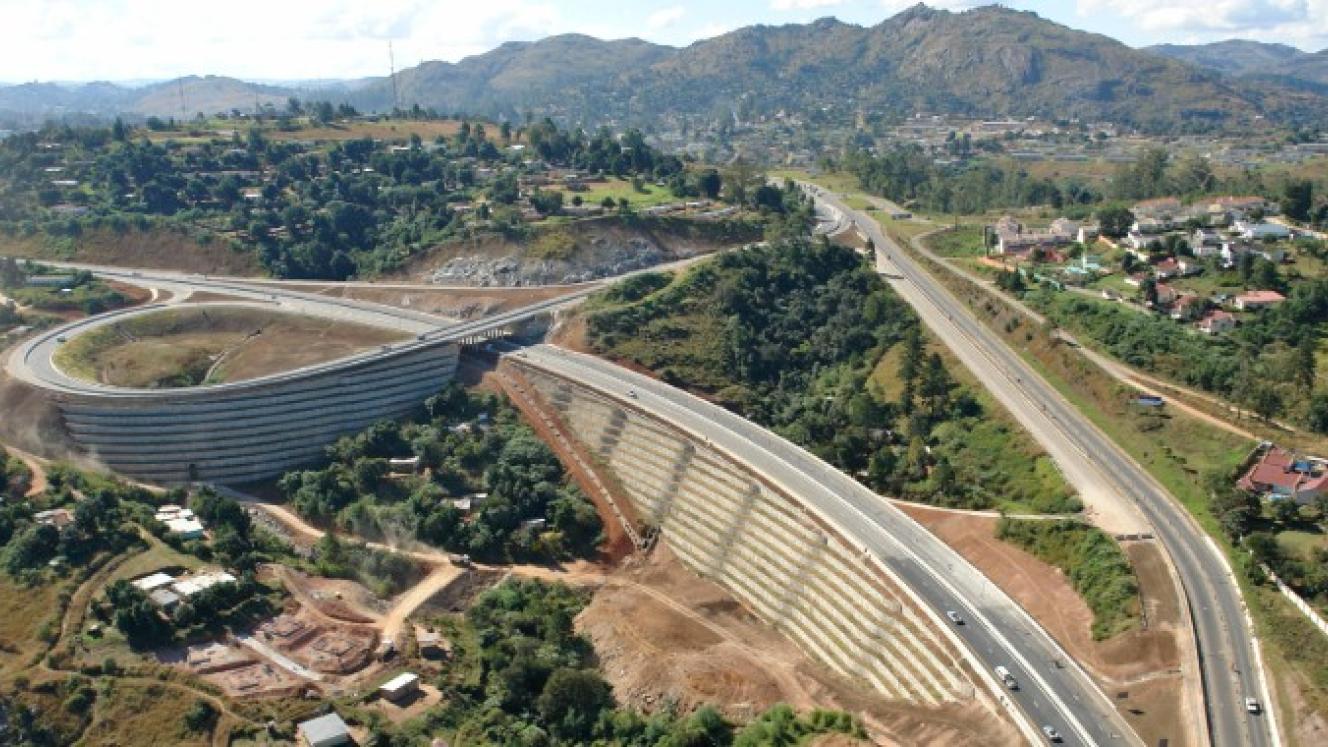

Further, Eswatini is a road route of increasing use by South African road freight haulers passing through the country as they move between Gauteng and Maputo and Mpumalanga and Durban, and the new road levy would impact that business. However, this time, the road council’s lobbying efforts were unsuccessful.

Road users in Eswatini consume about one million litres of fuel per day, according to the Eswatini Regulatory Authority Petroleum Industry Annual Compliance Report. The road levy would cost drivers about R146 million per year.