While the tide may be turning for shipping lines as port congestion eases along with the supply/demand ratio, they continued where they left off in 2021 and reported a very strong financial result for 2022.

Currently, 12 of the largest shipping lines have published their financial results – and their combined earnings before interest and tax (ebit) figures for the 2022 financial year (FY) amount to $95 billion.

This excludes CMA CGM (did not publish Ebit), COSCO, ONE, and PIL (had not published their FY accounts at the initial time of writing), and MSC (privately held so does not publish accounts).

“Adding in these remaining carriers, increases it to an estimated $208bn,” says Alan Murphy, CEO of maritime consultancy Sea-Intelligence.

“However, there is a weakness in the market that is highlighted by a sharp contraction in transported volumes, while the freight rates, though higher year on year, also seem to have slowed down."

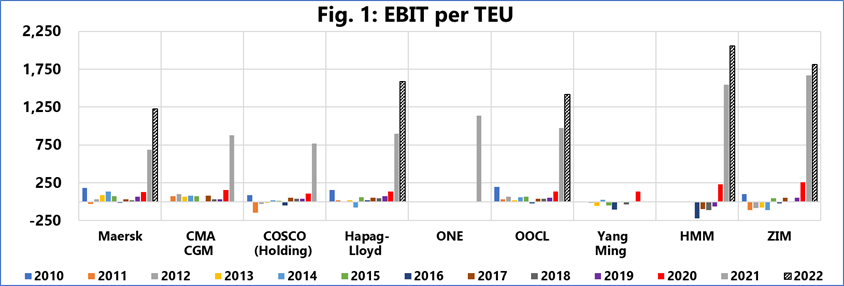

Figure 1 (see graph below) reflects the scale of the current profitability of the carriers, which shows the ebit/TEU of the lines that report on these figures. “While the larger shipping lines have close to doubled their Ebit/TEU, the smaller ones were only able to increase it by a relatively smaller margin,” Murphy points out.

“Even then, the ebit/TEU across the board continues to dwarf that of the previous years. HMM (2 055 ebit/TEU) reported the largest figure and was the only shipping line so far to record over 2 000 ebit/TEU in 2022‑FY, followed by ZIM with 1 815 ebit/TEU. The remaining shipping lines were within a range of 1 200‑1 600 ebit/TEU.