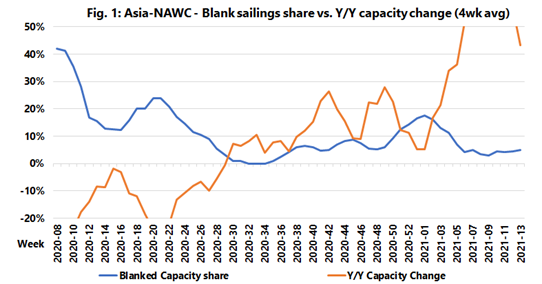

New data released by maritime consultancy Sea-Intelligence has debunked the “myth” that blanked sailings are to blame for the space constraints facing shippers on the major routes between Asia and the east and west coasts of North America.

As can also be seen in the graph below, the Asia-North America West Coast trade has seen a positive Y/Y capacity injection every month since July 2020, says Sea-Intelligence CEO Alan Murphy. “In other words, since July, the amount of capacity brought in through larger vessels and extra loaders has more than exceeded the amount of capacity removed through blank sailings. There have been periods where the growth in capacity injection was pushing 30% Y/Y, despite some sailings being blanked.”

He says there’s a similar pattern on the Asia-North America East Coast route, with a net positive capacity injection since July 2020, while Asia-North Europe has seen a net positive injection of capacity since August, and Asia-Mediterranean since October. “The data is thus clear. The carriers have not reduced deployed capacity, despite having blanked some sailings.”

Given the current container shipping market, with record-high freight rates, container and vessel capacity shortages, terminal and port congestion, and record-low schedule reliability, shippers are becoming increasingly frustrated. “In stakeholder discussions we have increasingly seen the suggestion, that part of the current rate spike has been manufactured by the carriers, through the “nefarious” use of blank sailings, despite an acute shortage of capacity.”

“Using a running four-week average to eliminate weekly spikes in capacity, which only serve to add noise to the data, the graph shows the Asia-North America West Coast blank sailing as a share of planned capacity, versus the Y/Y capacity change. We can clearly see from the figure that the number of blank sailings was extremely high during the Chinese production impact phase of the pandemic in February-March, as well as during the global spread of the pandemic in spring and early summer 2020.

“Blank sailings went to zero in late summer, but since then the number has increased again. There was a new spike in late 2020, and early 2021 as well. So there has been an increase in the number of blank sailings. But the current bottleneck problems do not mean that the carriers have also reduced capacity compared to a year earlier.”