As much as 3.6 million barrels a day (mmbd) of global refinery capacity has been assessed as being under high-risk of closure, according to Wood Mackenzie’s latest refinery closure threat analysis.

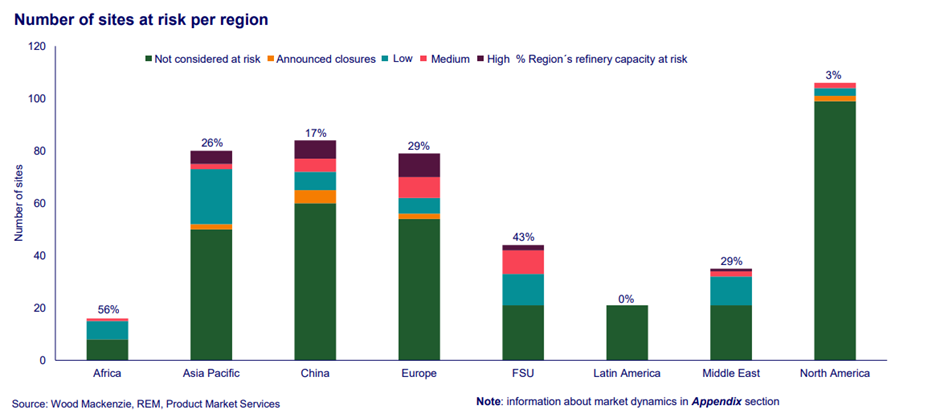

The report ‘Global refinery closure threat update’ shortlists 120 out of 465 refining assets at high, medium, or low risk of closure based on 2030 net cash margin (NCM) forecasts. The total global refinery capacity at some risk of closure amounts to 19.95 mmbd, equating to 21.3% of the 2023 total capacity.

Most of the sites identified in the report as high-risk are in Europe, with the continent making up 45% of the total. The 11 refineries are spread across the continent and most of them are standalone catalytic cracking sites.

“The European refinery sector will come under pressure in the mid-term as gasoline margins weaken and pressure to decarbonise increases,” said Emma Fox, senior oils and chemicals analyst at Wood Mackenzie.

“This will impact operating costs to such a degree that closure may be the only option.”

The seven high-risk sites in China are all independent assets that will suffer from the threat of competition against larger integrated sites, a more competitive domestic market as well as governmental policies in China that are not favourable to stand-alone operators.

Outside China there are 23 sites in Asia Pacific assessed by Wood Mackenzie as being at medium or low risk of closure. Japan alone accounts for 15 of the sites with 12 of those also having some degree of petrochemical integration.

Four of the remaining sites, spread across South Korea and Singapore, are at risk due to no decarbonisation projects being in place, despite being in carbon cost-applicable locations, while the other four, spread across Taiwan and Pakistan, suffer from low forecasted 2030 NCMs.

China has 12 sites assessed as low or medium risk with the majority having high emissions and no low-carbon investments currently planned. The region is assumed to be subject to carbon tax in 2030.

“The cost of decarbonisation for independent operators may be too high to justify keeping many of the sites in the Asia Pacific region operational, despite 70% of them having some degree of petrochemical integration,” Fox said.

“As the decade progresses and more pressure is applied to lower emissions, some difficult decisions will have to be made by operators.”

The report concluded that future carbon taxes could take up a significant portion of a refinery’s operating costs so facilities that invest in decarbonisation strategies could significantly improve their relative competitiveness. It adds that petrochemicals production at sites may not be enough to save many facilities, especially if they don’t have a diversified product slate.

“Standalone sites with high emissions are typically the first to face portfolio divestments or closures. But as the world embraces the energy transition, refiners need to adapt to survive,” Fox said.